For many people, having a regular job can help financial stability—assuming your boss doesn’t fire you, the company doesn’t go under, and your salary comfortably covers your monthly bills. If your job aligns with your career aspirations, there’s no need to quit. Instead, consider adding more income streams, like part-time gigs, side businesses, or passive/active investments.

Black Swan Events Explained: How to Prepare and Protect

I learned the term Black Swan when I read My Maid Invests in the Stock Market by Bo Sanchez. Parang kadikit ng “black swan” ay naiibang pagkakataon an may malalang negatibong pangitain o resulta. Kaya sa event an gaya nito ay kailangan na may solusyon ka. Isa na roon ang diversification o pag-i-invest sa iba’t ibang investments na hinahalintulad sa pagkakaroon ng maraming “basket.”

Ang diversification ay nagtuturo na unahan ang financial criris gaya ng pagkalugi sa negosyo at iba pang emergencies sa pamamagitan ng pag-i-invest sa iba’t ibang ventures.

Isa sa napapansin ko kasi lalo na sa young professionals or employees, even yung minimum wage earners, ay nagtyatyaga sa sahod nila then sobra-sobra at ‘di mapigil sa paggastos. Napakadaling mabulag when you have money to spend, nagkakaproblema na lang kapag may biglaang emergency at magpatong-patong na ang mga problema.

Tama yung sinabi noon Mr. Randell Tiongson sa Steps to Financial Peace summit, ang buhay ay may cycle hindi mo maiiwasan na gumastos at may pagkagastusan like illness, death, schooling, baptism, retirement and so on so forth.

Why Relying Solely on Salary Limits Your Financial Stability

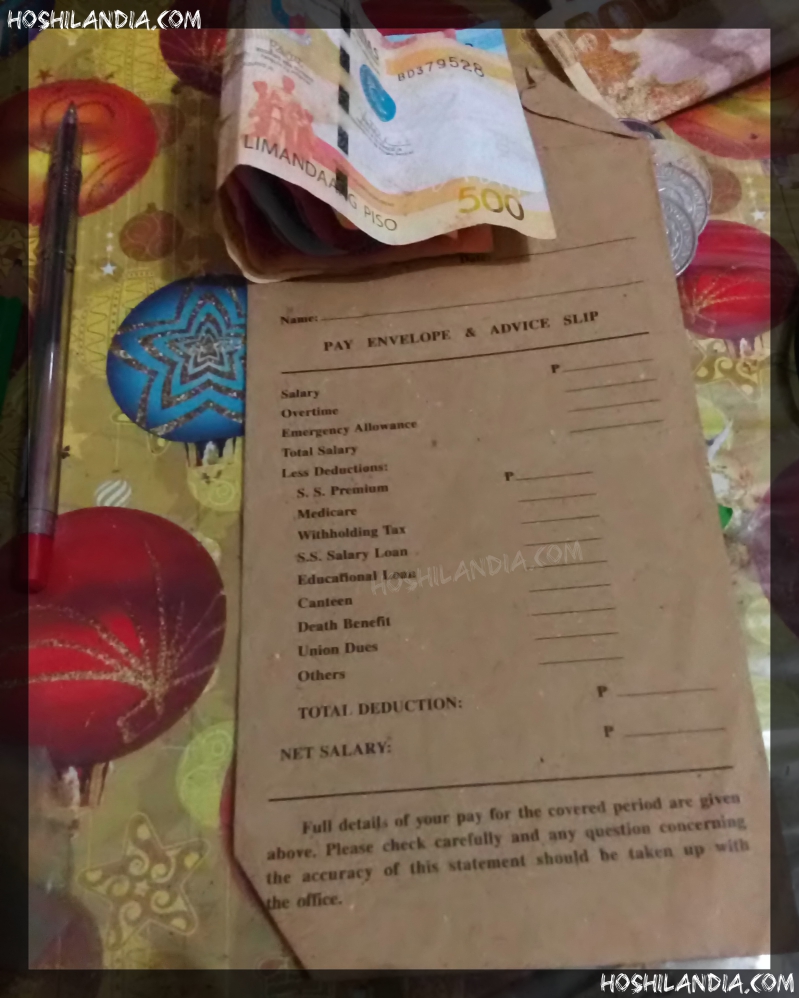

Ang siste kasi sa salary ay naka-fix ito unless if you’re a sales person na nakakatanggap ng commission or tip gaya dun sa mga staff sa fine dining restaurant. Kung iisipin, kailangan mo laging magtipid especially if you’re paying for something, want something or like me na nagbibigay ng “entrega” sa magulang.

Even I had a full-time day time job noon, I’m still looking for part time jobs or sideline businesses. When I started doing it kasi, kahit sabihin natin na barya lang nababawasan talaga yung…

- thought na iwan ang trabaho mo kahit like mo ito kasi ‘di ka happy sa sahod

- burn out na feeling mo lagi ka na lang nagso-short sa pera and need mo pa tumulong

- nagi-guilty kasi kailangan mong tumangging tumulong

- naaawa ka sa sarili mo dahil hindi mo mabili yung gusto mo kahit gustong-gusto mo at kailangan mo rin naman

- palaging umutang ng pera sa iyong kaibigan

- kaba na wala kang mahuhugot kung may dapat kang gastusin

- mawalan ng work

- mangarap (negosyo, bagong gadget o mag-travel)

Exploring Income Streams: Which Option Suits You Best?

Ano ang income stream? Ito yung mapagkukunan mo ng regular na kita na puwedeng sa isang activity or investment. Halimbawa nito ay sahod sa trabaho, kita sa negosyo, komisyon sa nabebentang produkto or serbisyo o pensyon na natatanggap ng mga senior.

May koneksyon dito ang kaalaman sa active and passive income stream.

Ano ang active income stream?

Ang example nito ay full-time job at negosyo. Tinatawag na active kasi pinaglalaanan mo ng panahon, energy o resources sa araw-araw.

Puwede ka naman magkaroon ng multiple income streams na active type. Pero practicallty, hindi lahat kayang magkaroon ng 3 full-time jobs. Tipong tulog at ihi na lang ang pahinga. Personally, I think it’s unhealthy and unsastisfying in the long run. Hindi rin sustainable kasi talagang stressful at need mo i-sacrifice and other important aspects of your life. Sometimes even paggo-grocery, pagsisimba, o panonood ng movie kasama ng iyong kapamilya hindi mo magagawa.

It is logical for me to have full-time and part-time jobs. Then, jackpot if either or both of them have a flexible time setup. In that way, you can still inject other activities for personal time, professional development, or financial growth.

Ano ang passive income stream?

Ang example nito ay dividend stocks, affiliate marketing, real estate rent at royalties sa isang creative work (book, song, o video). Tinatawag na “passive” kasi kikita ka kahit hindi mo masyado paglaanan ng oras at energy kapag nagtagal.

Most people overlook or ignore passive income streams kasi karamihan ng mga ito ay maliit ang kita sa simula o matagal bago ma-realize yung desired income. Mas gusto ng marami ang easy money at mataas agad-agad ang income. Ito rin ang dahilan kaya marami ang ginagamit ito bilang pang-akit sa kanilang scam method.

Which option suits you the best?

Maraming available na active at passive income streams. Kung sa passive income streams, ang impractical din na pasukin mo lahat. Hindi lahat ay match sa iyong kaalaman, kakayanan, at sitwasyon. Isa pa nakaka-distract ng priorities sa buhay.

Ang magandang step to discover more and know what makes sense is to learn more from books, articles, videos, or seminars. I’m a reader of Entrepreneur Magazine, Money Sense, Ready to Be Rich by Fitz Villafuerte, Truly Rich by Bo Sanchez, Business Tips by Victor Abrugar, and other business and finance blogs. Sobrang napakarami na actually na magagaling na content creator financial experts sa Youtube at Tiktok.

Conclusion

So, to solve your financial woes, it is better to find different enterprising endeavors. Kahit maliliit sa simula for as long as it can help you achieve your financial goals in the long term.

Pingback: 7 Truths about Working in the Philippines | aspectos de hitokiriHOSHI

Pingback: Confession of a Freelancer | aspectos de hitokiriHOSHI

I will do. susundin ko ang tips na ito ngayong taon. salamat sa pagsheshare madam hoshi. isa ka na ngang astig na serial entrepreneur. 🙂

wow, astig! pero sige iki-claim ko na yan Sir para ma-expereince ko at magkatotoo.

yeah goh basta kaya ng katawan, sched at may quality time ka pa with your family.